April 2025 Update

Current Thoughts

I thought last month was ’tumultuous’. As it turns out I knew nothing! ‘Liberation Day’ sparked chaos, and portfolios were down by double figure percentages. Annoyingly I’d deployed most of my spare unallocated cash by this time. I considered using my allocated cash holdings to take advantage, but then thought that either the market would get worse/stay the same, in which case no rush, or it would recover, in which case I wouldn’t feel any negative effects. The latter turned out to be true, so with my newly acquired PhD in hindsight I regret not taking advantage.

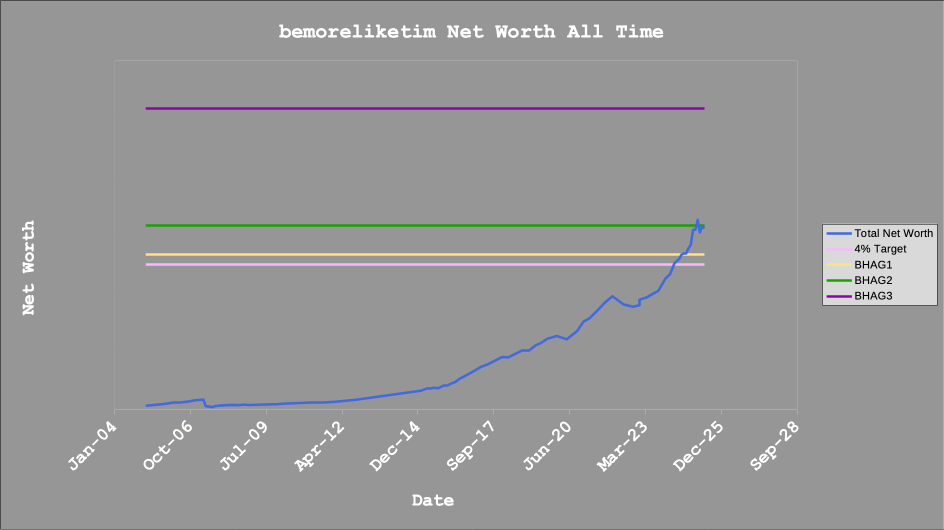

My learning from this whole episode is mainly a refresh around human fear. I saw a comment on a YouTube video about the situation in response to someone saying they’re using the downturn as an opportunity to buy, pointing out how this time it’s different and it’s going to be years before the market recovers. Turns out, my monthly chart doesn’t even register it. Next time maybe. The amount of energy expended talking, typing and worrying about this tiny blip in history was considerable, but to what use? No one doing the talking could change anything (apart from DJT). Everyone invested knows the risks and the ‘price of entry’. Hopefully the YouTube commenter above will learn. Or . . maybe he’s right and this was just the precursor to more chaos. Time will tell. In the meantime, just be cool. Stop with the flapping. Embrace the chaos. There’s nothing you can do to change it. And once you’ve got that nailed, enjoy life.

Vital Viewing

I love watching the All-In Podcast. This week their visitor was a very pleasant, sensible chap called Phillipe Laffont, who has a history of success running a hedge fund.

https://www.youtube.com/watch?v=g6HSFCQQ6O0

The section that interested me most was (from 1:17:30) where he plugged his new fund. It’s an attempt to bridge the gap between publicly available funds and funds only available to certified investors (the only certification needed is $). The minimum investment is $50k, so moderately accessible. I’m going to assume he has a good track record, all the best intentions and is a very intelligent investor, but would I invest in this? Not a chance. He may be one of the tiny percentage of investors that has outperformed the markets (I’m not sure), but even if he has, will he do it again? This is a lesson that’s already been signed, sealed and delivered. However, according to Phillipe, “It’s such an obvious idea that if I don’t do it, someone else will,”. Fund charges are 1.25% plus 12.5% of fund profits over 5%, plus other penalty charges for removing investments before a year is up etc etc. I’m not going to sweat the detail, but I can tell you that it’s going to need to blow the roof off to return anything more than a global index tracker. Let’s hope he succeeds and proves me wrong.

Net Worth Comments

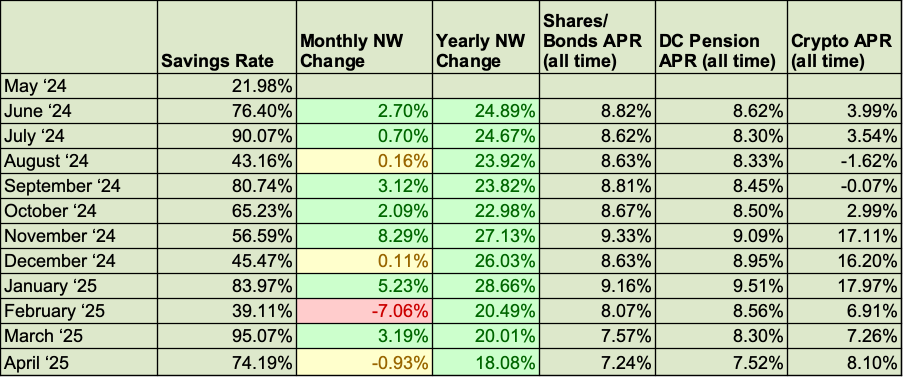

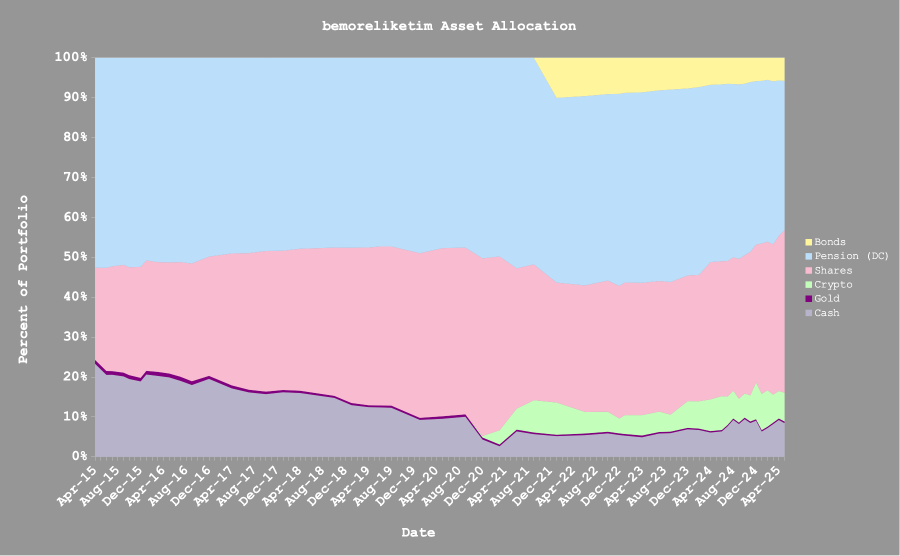

Pretty static since last month. The portfolio is in a consolidation phase. It’s being added to at a faster rate than ever before but overall valuations are going sideways. I like to think of this situation as similar to winding up a spring. Building potential energy. At some point in the future this base, the foundational work being carried out, will unwind and give me months of growth that I won’t believe, as it’s done multiple times before. Bring it on.